What is a Property Survey and Do I need It?

Reasons for Obtaining a Survey

.Reasons for Obtaining a Survey

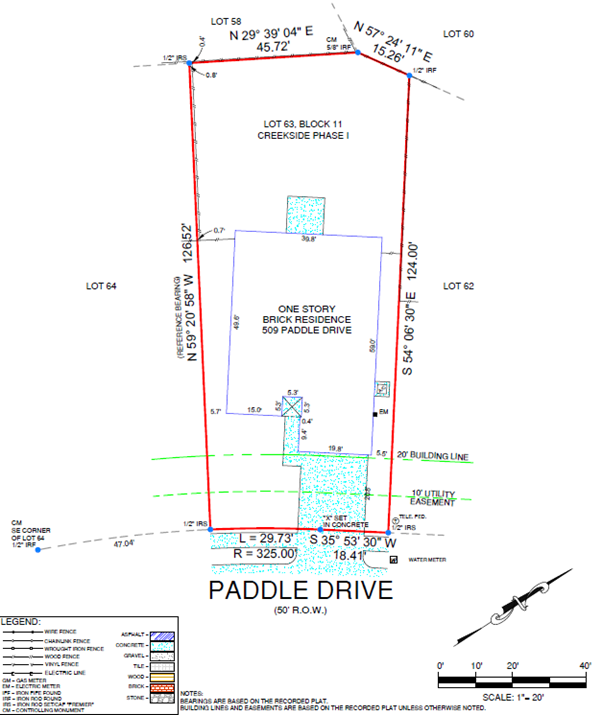

.Surveys are a part of nearly all modern real estate transactions. Many institutional lenders require a survey as a condition before making a loan secured by a mortgage encumbering real estate. An accurate survey, coupled with a physical inspection of the property, is by far the best way to determine the location of the boundaries of the property and the location of improvements on the property. It will also show whether the location of the property on the ground is the same as the written legal description.

The survey also adds value to your transactions by providing an additional level of protection coverable through title insurance. Most real estate transactions in the United States are covered by title insurance because of the protections it provides.

A current survey provides information that will allow a title insurance company to delete the exception for matters of survey in the title insurance policy, such as boundary lines, encroachments and parcel area.

A wise buyer will always obtain a survey to be certain that, among other things, the property is in fact located where the buyer thinks it is located. Nothing is more frustrating than discovering that the fence line is NOT the true property line, and your buyers just ‘lost’ twenty feet of property to their new neighbor.

A seller will generally be less concerned about a survey than will a buyer, unless the survey reveals problems or defects which the seller is obligated to remedy or unless the purchase price is based on the quantity of property (normally in terms of acreage or square feet) as determined by a survey.

What is survey coverage and why do you need it?

Survey coverage is additional title insurance coverage which protects the Buyer against errors on the survey. In accordance with the terms of the policy, benefits to the Buyer may include coverage and payment of loss arising out of the following, unless exception to such matters is taken in the policy:

- Dispute with adjoining landowners over location of boundary lines,

- Forced removal of improvements located across boundary lines,

- Forced removal of driveways encroaching onto adjoining property,

- Encroachment of improvements into easements or building setback lines.

A Buyer who does not obtain a new survey but relies on a previous survey would be well advised to purchase this coverage.

What if you have an existing survey?

You may have an older survey in your possession, perhaps given to you by the seller’s agent. There are advantages and disadvantages to using an existing survey instead of commissioning a new one:

Advantages:

- Useful to conceptualize property’s shape and size

- Inexpensive, often free

- Typically available from seller, county or title company in a short amount of time

Disadvantages:

- Not a current survey, reflects information available only up to the date the survey

was completed - May not include all of the information that is pertinent to your transaction. Often, there have been changes to easements, encroachments or other issues affecting the property that are not shown on an outdated survey. Here are some examples of potential problems:

- Utility company installation of new or updated transmission lines may result in changes to the existing easement, which may not be shown on an older survey.

- Existing survey may not show the existence or location of underground utilities that could affect the buyer’s plans for the property, such as installation of a sport court or expansion of the house. A new survey will disclose all of this information.

- May not have been intended for use in property transfer. For example, the survey may have been prepared only to locate one property line for installation of a fence or other appurtenance, or for construction of the house, and may not accurately reflect all the encumbrances or other features on the property.

- If the existing survey reveals problems such as evidence of unrecorded easements or encroachments, the time to face those problems and deal with them is before the contract is signed. Even if the seller’s agent does not have a survey, he or she might know about survey problems. For example, a neighbor may have built a fence or other structure that appears to cross over the boundary line.

Lender Requirements

The lender will sometimes impose requirements for the survey that are more onerous than (or at least different than) those you have imposed on behalf of your buyer client. This is more likely to be the case in a large commercial transaction. The best approach in that situation is to initiate communication between you, the surveyor and the lender’s attorney as early as possible so all parties understand the scope of the surveyor’s work and are satisfied with it. As a buyer’s representative anticipate a typical lender may be involved in the transaction at some point, so you should try to anticipate a typical lender’s requirements when you order the survey.

Why Do I need a Survey?

Mortgage lenders normally require a property survey before they will loan money for a mortgage, and many title insurers require this as well. Even if a survey has been done in the past, lenders will often times require a recent survey, generally one done within six months of the closing date. In Texas, many buyers will elect to use the previous survey from the sellers, but there are risks involved accepting an older survey. The surveyor is only liable to the original homeowner to whom that survey was first issued.

Due to various issues that may arise from using pre-existing surveys, our office devised a “Risk Management Form” which all buyers were required to sign should they decide to use an existing survey from the sellers. It basically states, “In the Texas Real Estate Commission(TREC) contract form #20-7, One to Four Family Residential Contract, and form # 25-5 Farm and Ranch Contract. Written in Paragraph 6, Title and Survey, the title insurance policy lists standard printed exceptions as to discrepancies, conflicts, and shortages in area or boundary lines, etc. Buyer, at Buyer’s expense, may have the exception amended to read “shortages in area”. Accepting a Survey from the Seller(s) to use in the closing of your home purchase may leave you liable.

Recent Posts